For Company A, the equity turnover ratio is more than Company B. ParticularsĪs mentioned before, if these companies are from similar industries, we can compare the turnover ratio of both of them. Now, let’s calculate the equity turnover ratio for both companies. ParticularsĪnd as we have the equity at the beginning of the year and the end of the year, we need to find out the average equity for both companies. Let’s do the calculation to determine the equity turnover ratio for both companies.įirst, as we have been given Gross Sales, we need to calculate the Net Sales for both companies. This move is very risky as by doing this, the organization is taking on the burden of too much debt, and eventually, they have to pay the debt with interest.Įquity Turnover Ratio Example Particulars If any company wants to increase the equity turnover ratio to attract more shareholders, it may skew the equity by increasing the debt percentage in the capital structure.So the comparison of ratios should be made among companies that belong to the same industry. For example, if we consider the turnover ratio of the oil refinery industry, it would be much less than a service business because the oil refinery needs large capital investment to generate sales. The equity turnover ratio varies greatly depending on the industry’s capital intensive.However, there are a couple of things about the ratio we need to pay heed to.

But if you take a general perspective, an increased proportion provides a positive indication, and a decreased proportion indicates a negative connotation. It isn’t easy to interpret the Equity Turnover Ratio. read more Excel Based Comprehensive Analysis Interpretation It provides valuable information about the organization's profitability, solvency, operational efficiency and liquidity positions as represented by the financial statements. You may also like – Ratio Analysis Definition Ratio Analysis Definition Ratio analysis is the quantitative interpretation of the company's financial performance. And then, we would find the mean of the sum of the total equity (beginning + end). To calculate the average shareholders’ equity, we need to consider the shareholders’ equity at the beginning of the year and end. We would take the net sales, which means we must exclude sales discount and sales returns (if any) from the gross sales to get the right figure.

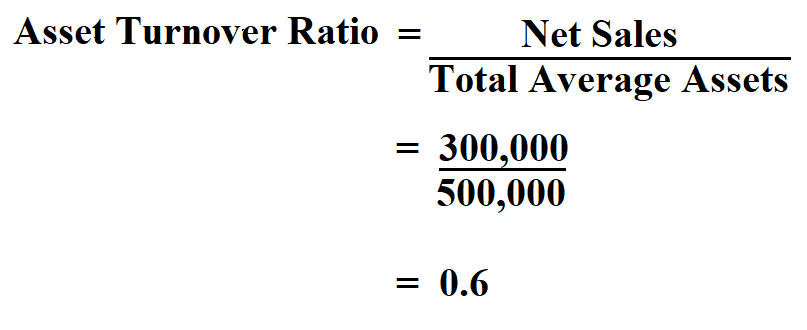

A gross sale is a figure inclusive of the sales discount and sales returns. When you make sales, it is net sales, not gross sales Gross Sales Gross Sales, also called Top-Line Sales of a Company, refers to the total sales amount earned over a given period, excluding returns, allowances, rebates, & any other discount. Now the question is what you would consider as sales. Source: Equity Turnover Ratio () Equity Turnover FormulaĮquity Turnover Formula = Net Sales / Average Shareholders’ Equity

#Turnover calculation how to#

You are free to use this image on your website, templates, etc., Please provide us with an attribution link How to Provide Attribution? Article Link to be Hyperlinked

0 kommentar(er)

0 kommentar(er)